FYI For Landlords

Did you know that owners of rental property located within the state of Maryland are required to follow the same regulations regarding security deposits as brokers?

Remember these provisions of the law…

The security deposit belongs to the tenant until legally declared forfeit. Security Deposits are held in trust…neither the owner nor a broker can touch that money.

Security deposits must be kept in a separate account located in a bank legally authorized to do business in Maryland.

Tenants MUST be paid interest at the rate of the greater of the daily U.S. Treasury yield curve rate (“Constant Maturity Treasury”) for one year, as of the first business day of each year, or 1.5%…even if your account pays less. The rate changed from 4% to 3% effective 10/1/04. Bear in mind, however, that if your lease states 4%, you must pay the higher rate until you amend the lease. If that lease is now month-to-month, a simple 30-day notice can amend this provision, but the higher rate applies until the date the notice places the new rate into effect. Simple interest is calculated at six months.

Maryland Security Deposit Interest Calculator

Damage inspections must be conducted within five calendar days on either side of the vacate date. This time limit is cast in concrete. It is NOT five business days. Tenants must be notified, in writing, of the appointed time for the final inspection. Failure to make such notification may result in Landlord’s loss of right to withhold damages.

Appropriate charges may be deducted only if the tenant is notified in writing within 45 days after vacating. Any remaining balance must be refunded, also within 45 days after vacating. The time limits are non-negotiable and are NOT business days.

Tenants do not have the right to waive their rights, verbally or in writing. Any such waiver of rights is invalid.

Violations of security deposit law by landlords may result in loss of forfeiture rights and/or payment to tenants of treble damages (three times the amount wrongfully withheld).

When a tenant fails to pay rent or otherwise violates lease terms, eviction is the most immediate remedy available to landlords. The District Court of Maryland is the authority to whom landlords petition for eviction.

Landlords may also have other rights including security deposit forfeiture or a civil judgment for damages (damages being defined as money owed to the landlord for any reason, including unpaid rent, late charges or physical property damage). But, when a landlord files suit for possession, the summons may be mailed to the tenant or tacked on the door. If damages are sought, the summons must be served on the person. So, including a request for a money judgment will likely delay any eviction.

When a landlord sues for possession, a court date is granted. Unless the tenant can demonstrate some pretty extenuating circumstances, the landlord is awarded judgment. This happens within about two weeks following the filing of the suit. Automatically, there is a waiting period (stay) of five days to enable the tenant to pay, which would thereby cancel the judgment for possession. You must accept the rent unless you have judgment absolute, which you can request on the 4th judgment in 12 consecutive months.

Once the stay has expired, if payment has not been received, the landlord may request a writ of restitution. That is the order for the Sheriff to authorize and supervise an eviction. By that time, some four to six weeks have passed. The deputy will notify the landlord of the date and time of the eviction and the number of workers needed to accomplish the eviction (in DC the US Marshall serve eviction writs and in Montgomery County, the landlord must call the Sheriff to schedule). It is the responsibility of the landlord to procure and pay for the crew.

District Court cases filed in one month, but not tried until after the first of the next month can now result in judgment for the subsequent month without re-filing! The landlord must request, on the original petition, any additional rents which come due prior to the court date. Also, District Court cases may now include late charges and other charges due “as additional rent”. Furthermore, any charges carried forward into a subsequent month (i.e.: damages, late charges, legal fees) carry forward as “rent” and are subject to District Court judgment. Remember, at any time up to the date of the eviction, if the tenant pays, only the amount due under the judgment or the pending case, the process comes to a screeching halt. It is possible to sue for January rent, have a trial in February, schedule an eviction in April and show up with a 15-member eviction crew, only to have the tenant hand you the January rent (and February if you remember to ask for judgment for February) and send you away. You are out the cost of the workers and all the legal work. In Maryland, landlords may charge the tenant for the legal fees and court costs provided the lease so states. In DC, only the court costs may be passed on.

So, this can go on and on and on… but there are limits. First, when the original lease term expires, landlords can simply discontinue the tenancy by giving the appropriate notice. At this one moment in time, the expiration of the initial lease term, the landlord has the absolute right NOT to continue the tenancy. This is different from a lease termination—it is an election not to renew. Tenant’s rights to dispute this election are much more limited and a retaliation argument is not allowed. This is true ONLY at the expiration of the initial lease term, so this is the best time to terminate a bad tenancy.

There was a time, not too long ago, when the seller or landlord in a real estate transaction paid the broker and that settled the issue. All the agents represented the seller or landlord and nobody represented the buyer or tenant. Today it is necessary to discuss agency or representation when using the services of a real estate company.

Let’s talk about what representation means for a moment. As a seller or landlord, having an agent represent you means your agent has a responsibility to you. The agent is to look out for your best interests. This means to endeavor to secure the highest price possible; to seek qualified purchasers or tenants who will be able to complete the transaction; to keep confidential any non-material information you disclose which might adversely affect your ability to achieve these goals. Some of these facts might include that you are selling due to a divorce or major health problem or that you have to sell or rent within a specific time period to start a new job elsewhere. This knowledge in the hands of your purchaser or tenant can give them an upper hand in the negotiating process.

For buyers or renters, having an agent represent you means essentially the same benefits afforded sellers or landlords above would be available to you. Your agent should review comparable transactions to ensure that you are not paying too much; your agent should keep information about your personal situation confidential to the extent that it might place you in a poor negotiating position; your agent should advise you that you have the right to certain inspections or certifications to which you are not automatically entitled. Further, your agent must disclose to you any information the seller or landlord or their agent lets slip that could give you a step up in negotiating a better deal.

Now, for both, it is important to realize that there is certain information which should never be disclosed. There are laws directed at “stigmatized properties”. Such properties, for example, would include those in which a murder took place or an occupant died of AIDS. In these cases, the information pertains to people; not properties. If the property was in a flood plain or on an earthquake fault line, that pertains to the property. Information about the property, even (or especially) if adverse or latent (not obvious), must be disclosed. Information about the occupants cannot be disclosed. As an agent, if a renter or buyer asks me if any prior occupant died of AIDS, I must refuse to answer. It is a violation of law to disclose that information. If I, as an agent, fail to tell a buyer or renter that the house had a wet basement, I could be liable, but I cannot even be sued for failing to disclose information about stigmatized properties.

In the old days, the seller or landlord paid the commission and the agent represented that party. Agents spent a lot of time working with buyers and renters “helping” them find a suitable property, never telling them that they represented the other side in this transaction. Now, that is considered unfair. So, that all parties must have a written agency agreement and disclosure.

For a buyer or renter, hiring an agent means that you truly have someone in your corner. Your agent should negotiate a fee for services and a method of payment as well as a description of services. For example, you may be able to expect your agent to set down the features you want in a home including bedrooms, price & location. Then, your agent may be required to conduct a multiple list search at least weekly and to report the findings in writing or by phone. This may go on for a period of say a month or three months. You may be required to pay something in advance, something at closing or both. Your agreement may state that you are responsible for the fees or any portion of the fee that the seller or landlord is not willing to pay on your behalf. The result may be that you pay nothing out of pocket.

Sellers & landlords still get the same benefits they always have. Their agents generally advertise, hold open houses, analyze and present offers and help close the transaction. So, why would a seller or landlord be willing to pay the buyer’s or renter’s agent? Simple economics… the buyers and renters don’t always have the money. But, in exchange for paying that fee and allowing buyer brokerage, much of the liability is shifted to the buyer/renter’s agent. If your own agent forgets to tell a buyer that you have a wet basement, you and your agent can be held responsible. But, if the information is disclosed to the buyer/renter’s agent and that agent fails to disclose the information, it is that agent who is at fault. And, the fact is, that the fee you pay to the buyer’s or renter’s agent is generally the same or comparable to the fee you would have paid to a cooperating agent or subagent under the old ways. The buyer’s or renter’s agent replaces the cooperating agent.

One other point to remember is that it is currently illegal in Maryland for an agent to represent both parties in a real estate transaction. So, once a buyer or renter hires an agent, that agent can no longer show his or her own listings to that buyer. So called, Dual Agency, may exist in Maryland provided the Dual Agent is the Broker and two other agents in the same firm represent the buyer/renter and the seller/landlord. The Broker may not represent either party.

Let’s face it, the way we used to do business was a fallacy. Agents drove buyers and renters around in their cars, sometimes for days. They became friends. They ate together. The buyers / renters believed the agent was “helping” them and the agents had a hard time remembering that each home they set foot in created a new agent/client relationship in which they represented that seller or landlord against their newfound friends. The new way allows everyone to love the one they’re with.

Rental property is insured as a business whereas a personal residence is covered under a homeowner’s policy. There are a few basic differences. The main difference is that a homeowner’s policy covers furniture, but landlords generally remove their furniture. The renter’s furniture isn’t covered.

Business property carries a greater liability, so the cost of the liability coverage offsets the savings on the furniture coverage.

As with homeowner’s insurance, the Rental Dwelling Policy offers an option for Replacement Cost Coverage. This means pretty much what it’s name implies. If there’s a loss, say due to a fire, the cost of the repair or replacement will be covered. Without this coverage, the age of the component (carpet, cabinets, the walls themselves) will be depreciated. So, if, for example, the insurance company says the kitchen cabinets have a useful life of 20 years and the fire happens when the property is 10 years old, the $8000 replacement will result in only $4000 coverage (less your deductible). This is because the cabinets had already lived half their useful life and only had half left. The insurance company pays only that half remaining. With Replacement Cost Coverage, if the fire happened after 22 years, when the cabinets were beyond their useful life, the new cabinets would be paid for by insurance (less the policy deductible).

The savings does not justify the election to forego the Replacement Cost Coverage. In the case of a fire or other insurable disaster, the depreciation can easily result in a payment thousands of dollars short of the amount needed to restore the damage.

Another option offered to landlords is Loss of Rents. Now, this doesn’t cover losses due to vacancies or delinquent rents. The purpose of this coverage is to provide an income to the landlord during the period of restoration. Fires can take from a few months to a year to repair. Meanwhile, there’s no tenant making payments yet the mortgage company still wants its payments. This coverage will generally provide something in the vicinity of 80% of the rental income. Since there is no maintenance or management during this period, that is the net equivalent to full payment. Again, this is a very inexpensive and worthwhile option.

Finally, when utilizing the services of a management company, landlords should ask that the insurance provide liability coverage for the agent. When there is a liability suit, both the landlord and the agent will likely be named as defendants. There should be no need to have separate coverage. Most insurance carriers will add the agent at no cost and many have the agent named in the pre-printed form.

Both Rental Dwelling Policies and Renter’s Policies are available through any major insurance carrier. Often, we are asked if owners of condominium units need to get insurance. Invariably, we say, “Yes.” The association may have coverage for the major structure, you need to cover lost rent and the increased cost of upgrades such as countertops, cabinets and flooring (known as betterments). You will also need liability coverage.

Massive changes have taken place in Maryland Condo law. It is now law that the condominium must cover the structure for replacement back to the condition of the original sale by the developer. Previously, it was often left to the owner to insure the interior of the unit, including kitchens and baths. No longer. These are building components covered by the master policy, except for the added cost of betterments made by you. Another change relates to the application of the master policy deductible. While you may be covered, if the damage originated from your unit, you are now automatically responsible for payment of the condominium master policy deductible up to $5,000. If you have your own condominium landlord’s policy, you can have them include the deductible so you’re covered for that claim with the exception of your own policy deductible. For example, if you have a $500 deductible and the damage to your unit is 20,000, you’ll get $19,500; $15,000 from the master policy and $4,500 from your police ($5,000 less the $500 deductible). But, if the damage started in your unit and affected five other units for a total loss of $1.7 million, the condo master policy should cover all but $5,000 of the $1.7 million—you’ll pay the first $5,000. But, you can have your policy pick up $4,500 of that (because you have a $500 deductible.) Be sure to consult your insurance agent. Let them know that you own a condominium that you will be renting. You need to cover the master policy deductible and you need to name Majerle Management, Inc. as additional insured on the liability portion. We recommend at least $1 million in liability coverage.

MARYLAND’S LEAD PAINT RISK REDUCTION PROGRAM

For up to the minute changes, please visit our Community Links page and click on Government and Maryland Dept of the Environment. In 2011, the Maryland Court of Appeals struck-down the protections landlords receive under the Maryland Lead Poisoning Prevention Program. In addition, the law was expanded to require registration of all pre-1978 rental properties and/or to increase the registration fee.

Effective February 24, 1996, all rental units constructed prior to 1978 (construction date is considered to be the date the construction permit was issued) must be registered with the Maryland Department of the Environment (MDE). If you have not registered, you should contact MDE at 1-800-776-2706.

It is illegal to rent a pre-1978 property without a disclosure of any known lead-based paint as well as test result. Testing is required for all pre-1950 properties.

There are two types of acceptable lead test under this law. There are other lead tests, but they are not accepted. The tests are a Dust Wipe and the XRF or X-Ray Fluorescent test. Remember, the law was written to protect landlords and that protection has now evaporated, so we must approach testing differently, as a result.

In the past, the Dust Wipe may have indicated that the levels of lead dust, at the time of testing, were “acceptable”. We could get them into the acceptable range by merely washing horizontal surfaces before testing. Today, there is no acceptable level of lead dust. In order for a tenant to sue the landlord, they simply need to prove three things:

1. A member of the household has elevated blood lead levels; 2. There is a presence of lead-based paint anywhere in or on the property; 3. They have occupied the property for more than 30 days.

So, having lead paint puts the landlord at risk even if the paint is in good condition. The tenant may have inhaled or consumed lead elsewhere, but meets the three requirements to lay blame on the landlord.

Because of this, we are now recommending (requiring, if we are to manage the property) that an XRF test be performed. The XRF will involve reading through 26 layers of paint and the testing of hundreds of interior and exterior components. The test report will identify specifically where lead-based paint was found. Then, using an MDE-Qualified Lead Paint Abatement Contractor, those components may be replaced, stripped or encapsulated. Only then is the landlord in a position to successfully defend a lead poisoning lawsuit.

The cost of an XRF ranges from about $300 to $500 or more, depending upon the size of the property.

We often hear owners say that they tested the property when they bought it. That’s nice, but the usual home test does not meet the requirements under this rental property law.

Is that all? Almost. Each lease entered into after February 24, 1996 must include a disclosure form (to comply with EPA regulations), an EPA brochure on lead-based paint in homes plus a brochure provided by the Maryland Department of the Environment. You will receive these when you register the property and you may use photo copies as needed for future use. Finally, if the same tenant remains in the property for two years, you must provide additional copies of the EPA and MDE brochures again, every two years.

If you are a Landlord who does his or her own maintenance, you may wonder whether you can perform these treatments yourself. The answer is maybe. If you are actually about to become a Landlord and currently live in the to – be – rental – unit, you may perform the treatments, but an accredited Supervisor must certify, in writing, that the treatments were performed correctly AND there must be a visual inspection performed by an accredited inspector. Landlords can obtain a list of approved testing and abatement companies from the MDE or by calling Majerle.

But wait, now the feds have gotten involved. Even if you are the owner of the rental property, if the property was built before 1978, in order to work on projects that will disturb painted surfaces, you will have to be certified under the EPA’s RRP (Repair, Renovation and Painting) Rule. If you disturb paint and you are not certified, the EPA is levying fines in the $10s of thousands per violation–and each area you disturb is a separate violation. No owner or contractor may work on ANY pre-1978 property–rental or otherwise–without the RRP certification.

It’s clearly best to test and leave the corrective measures to qualified contractors. The risk is simply too great to take the chance.

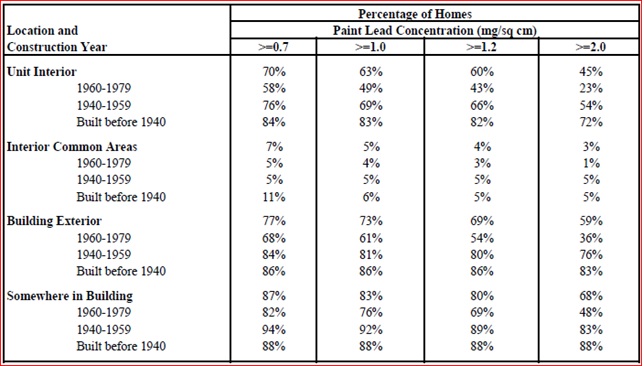

Oh, you ask, “What are the chances? According to the June 1995 REPORT ON THE NATIONAL SURVEY OF LEAD-BASED PAINT IN HOUSING Appendix II: Analysis conducted jointly by HUD and the EPA, here’s your answer:

Additional Quick Links

- – For Owners

- – Full Service Property Management

- – Vacancy Marketing

- – Tenant Screening and Lease-Up

- – Accounting

- – Maintenance

- – Property Inspections

- – Administrative Paperwork

- – Cooperative Marketing

- – Lease Purchase

- – Military Appreciation

- – Fee Schedule

- – FYI for Landlords

- – For Renters

- – Qualifying to Rent

- – Insurance For Renters

- – Investors

- – Rent Payment Options